Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

In the coming weeks, the U.S. Treasury will begin refilling its General Account (TGA), a process that will pull $500-600B of cash out of markets over ~2 months.

On its own, that might sound routine. But this cycle is unfolding into one of the most fragile liquidity backdrops of the past decade.

In 2023, a $550B TGA rebuild was cushioned by over $2T in the Fed’s Reverse Repo Facility, healthy bank reserves and strong foreign Treasury demand.

Those buffers are now gone.

The Fed is still draining liquidity via QT, the RRP is nearly empty, banks are constrained by losses and capital rules, and foreign buyers from China to Japan have stepped back.

The result: every new dollar raised by Treasury this fall will come directly from active market liquidity.

That matters because it changes how the shock transmits. In 2021, stablecoin supply expanded even as the TGA rose, reflecting the abundance of post-COVID liquidity. In 2023, stablecoin supply contracted by more than $5B and crypto stalled, showing how the drain hit digital dollar rails. In 2025, conditions are tighter still — making crypto the first place where funding stress could surface.

And the risk is not uniform across assets.

Higher-beta tokens amplify drawdowns when liquidity tightens. If stablecoin supply contracts during this refill, ETH and other risk-curve assets are likely to see disproportionately larger declines relative to BTC, unless they have offsetting structural inflows from ETFs or corporate treasuries. In a thin-liquidity regime, position sizing and capital rotation across the risk curve will matter more than ever.

But this cycle also introduces a structural twist.

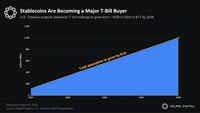

Stablecoins are no longer just collateral damage; they are becoming buyers of Treasuries themselves.

Tether and Circle now hold over $120B in U.S. government debt, larger than many sovereigns. Treasury projects stablecoin demand for bills could rise to $1T by 2028, creating a feedback loop where digital dollar rails directly absorb U.S. issuance.

How the 2025 TGA Refill May Unfold

The liquidity impact won’t arrive in a single shock. Based on historical cycles and today’s conditions, this is how I expect it to play out in four phases:

Phase 1 (Early Aug–Late Aug): seasonal strength, BTC & ETH gains into FOMC.

Phase 2 (Sept): sharp liquidity shock as issuance front-loads.

Phase 3 (Oct–Nov): fatigue, stablecoin contraction risk, M2 rolling over.

Phase 4 (Dec–Jan): headwind fades, recovery potential.

The signal to watch is simple: stablecoin supply vs TGA balance.

If stablecoins expand while the TGA climbs, crypto may absorb the shock better than past cycles. If supply contracts, the drain will transmit faster and more forcefully.

The 2025 TGA refill is not an open-ended bearish story but rather it is a defined liquidity headwind that will shape capital flows through Q4. The eventual completion may set the stage for the next rally. Until then, liquidity deserves more respect than headlines.

35,29K

Johtavat

Rankkaus

Suosikit