Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I think I have gotten a few things right this past year, but I absolutely have gotten Japan's long-end wrong --

Fully expected Japanese institutional money invested in foreign bonds to come home at yields well 3 ...

Good/ fun article from Toby Nangle

1/

Very interesting.

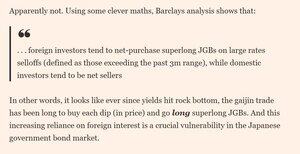

"foreigners represent an increasingly large share of trading volumes at the long and superlong parts of the curve — between a fifth and a third"

2/

What's crazy (to me) is that the lack of domestic demand for long-dated JGBs is mostly a policy choice.

The GPIF choose to diversify away from JGBs into foreign bonds/ equities ... and the regulated insurers are taking much bigger risks with their foreign portfolios

3/

And while it is probably not relevant for the 30y part of the curve, in a sane world Post bank would be a bigger buyer of JGBs than foreign bonds ... it was forced into foreign bonds once upon a time by the lack of yield in JGBs/ a flat curve

4/

Seems obvious to me that the underwater positions of most domestic institutions in long dated JGBs (the banks bought a lot back during the days when the curve was flat) + their underwater position in foreign bonds has frozen balance sheets ...

5/

And frozen domestic balance sheets led to a reliance on foreign demand for long-dated bonds in a country that has zero need to rely on foreign demand for its bonds (See Japan's NIIP)!

Great, very FTy, stuff

6/6

24,62K

Johtavat

Rankkaus

Suosikit