Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Goldman Sachs said: If the Fed loses its independence, gold will rise to $5,000!

This seems to be a warning ⚠️ to Trump, if the Fed eventually becomes Trump's puppet, then not only gold, but #BTC may soar to $200,000! 🧐

Sep 4, 17:35

Recently, many fan partners have consulted me, 'What is the logic behind the recent surge in gold?' '

Today, gold has exceeded $3,600 per ounce, and the mainland has also exceeded $1,000 per gram in one fell swoop

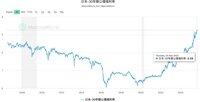

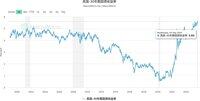

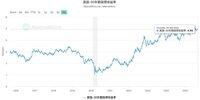

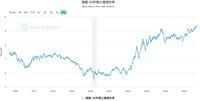

In addition, our community partners also asked a very interesting question: 'Didn't they all say that they were entering a cycle of interest rate cuts?' Why did the yield on 30-year Treasury bonds soar and the price fell all the way? (As shown in 👇 the figure, the yield on 30-year Treasury bonds in the United States, Japan, Britain, Germany and other countries has recently jumped)

In fact, these two questions are essentially the same problem, the essence is the same, I will break it down today:

1️⃣ The logic of long-term funds has changed

The essence of long-term treasury bonds is that you lend money to the government for 30 years now in exchange for interest. The core logic that determines its price is: future inflation level + central bank attitude + government fiscal credit.

In the past ten years, low inflation, unlimited central bank coverage, and stable finances have all been stacked together, and everyone has dared to buy long-term bonds. At that time, buying 30-year treasury bonds was stable, fragrant and reliable.

But now, all three support points have collapsed:

❌ Inflation can't be suppressed, and oil prices and wages are pushing up.

❌ The central bank itself is hesitating and can no longer print money indefinitely.

❌ Governments are borrowing more and more money, and the supply of national bonds has exploded.

People who buy bonds began to wonder: can this thing really be worth so much, can it really be stable for 30 years?

2️⃣ Why are yields rising?

Yield is the reflection of price. No one dares to take over, the price falls, and the yield naturally soars. Like the UK, the 30-year yield has surged to 5.68%, the highest since 1998. On the Japanese side, it is even more exaggerated, countries with zero interest rates in the past, and now the 30-year yield has also exceeded 3.2%, setting a historical record.

This is essentially market players roaring: I want higher interest to make up for greater risks in the future!

3️⃣ Interest rate cuts ≠ bond bulls

Previous experience is that as long as the central bank cuts interest rates, a big bull market in the bond market will follow. But this time it's different. Because the background of interest rate cuts is not simply economic weakness, but high inflation + high debt.

Even if the central bank cuts interest rates, the market does not believe that it can persist, because the government has to continue to issue bonds for financing, where does the money come from? Without anyone to cover the bottom, interest rates can only be raised to "lure" buyers back.

4️⃣ Political uncertainty has become an accelerator

France's vote of no confidence, Japan's ruling party is in turmoil, and the internal fiscal spending of the United States is arguing, all of which have become "risk premiums" on long-term bonds.

In the past, when buying long-term bonds from the United States, the United Kingdom, and Japan, everyone thought it was a risk-free interest rate; I don't dare to think so now. The anchors of sovereign credit are being pulled out one by one.

5️⃣ Why did gold and silver rise (also good for #BTC)?

It's simple: when the "risk-free" label of long-term bonds falls, investors look for a new "anchor". Gold and silver are natural substitutes, not relying on government credit, and are recognized by the world. The bond market is collapsing, and precious metals have become a safe haven for funds, which is also good for cryptocurrencies such as #BTC.

So, in general, now that the 30-year Treasury yield has skyrocketed, it is essentially the market repriced into the future:

· Accept a higher and more sustained interest rate environment;

· accept that the government is no longer a "sound borrower";

· Accept that the central bank can no longer be a takeover forever.

This is why the logic that should have been "interest rate cut = debt bull" has failed. The market wants a new balance, and the process is painful. So I think that the current 30-year long-term bonds are the stage of "prices squeeze water down and yields find anchors up". Don't fantasize about a violent rebound in the short term, long-term funds should continue to be revalued, and embracing safe-haven assets may be the right option! 🧐

77.76K

Top

Ranking

Favorites