Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

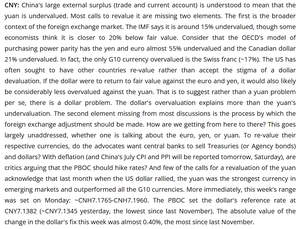

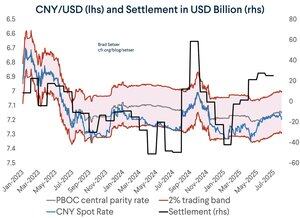

Chinese state banks were buying fx to keep the CNY at the fix during the second quarter; with China now intervening to hold the CNY down (v the USD) it would not be hard to engineer a stronger yuan ...

1/

8.8. klo 18.17

Seems rich that while US tariffs disrupt global trade, many call on China to allow the yuan to appreciate for the good of the world economy. The $JPY and $euro are more undervalued. The real problem is the overvalued dollar. My take:

Spoiler:

Apart from a brief period in q1 when the market feared China would respond to Trump tariffs with a CNY depreciation, fx settlement has been positive since September --indicating that China's state actors are generally pushing the CNY down.

2/

China can also guide the yuan stronger through a series of stronger fixes -- as the yuan starts to appreciation, exporters tend to convert dollars back into yuan, adding to the underlying pressure

4/

The TWD and the JPY are also undervalued, tis true --

But it wouldn't be hard to engineer a stronger TWD. Taiwan's central bank blocked appreciation pressure consistently through intervention in q2, and any rise in the TWD through 29 would force a lot of hedging ...

5/

The challenge for Taiwan is that once the TWD starts to appreciate it risks really appreciating, given the massive scale of the open position in its insurance sector and all the unhedged ETFs and onshore dollar deposits that could move back into TWD

6/

As for the yen, well, Ueda has been slow to hike, but inflation is quite high and real rates are negative, so the BoJ should be hiking more soon ...

7/

The MoF could reinforce any strengthening of the yen by introducing a policy where the interest proceeds on its existing reserves will be sold for yen -- generating a sustained bid for yen (and helping with Japan's fiscal position)

8/

And while it is institutionally difficult, a decision could be taken for the GPIF to take profits on its massive foreign portfolio -- and either reduce its foreign allocation and return to long-dated JGBs (which offer decent yield) or to start hedging ...

9/

And the regs around the life insurance industry could be changed as well to reduce the scope for the lifers to continue to run large open positions (via holdings of foreign bonds unhedged)

10/

My point is simple -- the big Asian governments have their thumb on the fx market in a lot of different ways, and the key players (Korea too, via the NPS and its hedging) have the ability to move the fx market if they so desire ...

11/11

38,66K

Johtavat

Rankkaus

Suosikit