Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

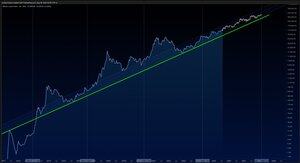

Two potential paths for Bitcoin nobody I know of has presented. Both rooted in long-term compounding math, together I estimate with greater than 80% probability of playing out.

Both paths ultimately respect the same long-term log regression the difference is whether this cycle produces one final blow-off (which comes much later in the cycle than believed) or Bitcoin is already evolving into a “steady grind” mega-asset.

Base case (60–65% probability):

Path 1 (grind within channel).

Bitcoin is transitioning from early adopter → early majority phase.

Historically, assets entering institutional adoption see dampened volatility. The emergence of ETFs and global liquidity flows suggest a “smoother curve” rather than massive blow-offs every 4 years.

If Bitcoin is truly leaving the "early speculative phase" and entering monetary adoption, this is the most likely path ahead.

There are two more paths that need to be shared for this conversation.

92,69K

Johtavat

Rankkaus

Suosikit