Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

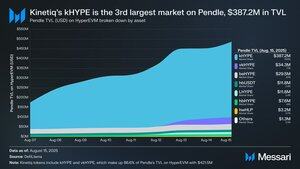

Kinetiq is the fastest-growing protocol on @HyperliquidX, the fastest-growing liquid staking token ever, and the largest liquid holder of $HYPE.

It connects native staking of HYPE on HyperCore with the composability of a burgeoning DeFi ecosystem on HyperEVM. The deployment of @pendle_fi onto HyperEVM has added fuel to the fire.

In just one week, HyperEVM has become the second-largest contributor of Pendle TVL behind Ethereum.

Kinetiq markets on Pendle (kHYPE and vkHYPE) have attracted $421.5 million in TVL as $kHYPE has become the third-largest market on Pendle. In total, 32.2% of kHYPE's supply is deployed on Pendle, making up 86.6% of Pendle's TVL on Hyperliquid.

Kinetiq’s ambition extends beyond liquid staking and institutional adoption. The protocol aims to allow builders to create HIP-3 markets with increased capital efficiency.

While not yet live, HIP-3 markets will allow anyone to create exotic perpetual futures markets atop Hyperliquid. For example, @ventuals_ will allow users to trade pre-IPO companies like @cursor_ai, @cluely, and @krakenfx with up to 10x leverage.

HIP-3 builders will need to acquire and stake one million $HYPE ($48.5M) to deploy. Kinetiq will provide the option to rent stake for a to-be-announced price through Launch, an Exchange-as-a-Service (EaaS) product.

This presents strategic questions for @kinetiq_xyz. Will the price to rent stake be a fixed rate, an algorithmic rate, or a rate related to the success of the underlying HIP-3 market?

Sophisticated HIP-3 deployers may be able to secure stake themselves. This could limit Kinetiq’s ability to attract what will become the highest-performing HIP-3 markets and restrict the attractiveness of a revenue share.

Kinetiq could support 28 HIP-3 builders with over 28.7 million HYPE being staked today.

The success of HIP-3 and its revenue-generating potential remain to be seen. If @kinetiq_xyz opts for a revenue-share model, revenue could be capped if HIP-3 struggles to take off. Changing the protocol’s pricing strategy after setting an initial methodology would prove challenging.

That being said, if the long-term growth and success of Hyperliquid is an assumption, revenue-sharing becomes the optimal option. That assumption is guaranteed to be one held by Kinetiq and its founders, like @0xOmnia, who have proven to be some of the most Hyperliquid-aligned builders in the @HyperliquidX ecosystem.

46,58K

Johtavat

Rankkaus

Suosikit