热门话题

#

Bonk 生态迷因币展现强韧势头

#

有消息称 Pump.fun 计划 40 亿估值发币,引发市场猜测

#

Solana 新代币发射平台 Boop.Fun 风头正劲

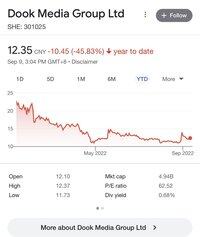

In the domestic market, it's still best to stay away from A-shares. Recently, a company called Rongxin Culture went public. On the first day of trading, the stock price soared to 35. The PE ratio directly jumped to over 70. In the past few days, the stock price has dropped by about 15%. The PE ratio is still around 62. Similarly, Duku Culture has already dropped by half this year, but the PE ratio is still 62. What kind of company is this? Is there any potential for high growth like technology companies? How many copyrights do they actually hold?

热门

排行

收藏