Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Top 10 Bull-Market Top Indicators 📈

CT is flooded with “top” calls, most of it noise. If we’re in inning 3–4 of 4, here’s a clean look at the most reliable top signals and where they sit right now.

Let’s get started 👇

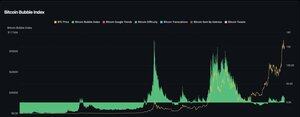

4. Bitcoin Bubble Index

Built by Weibo user “Ma Chao Terminal” and open-sourced on GitHub, this Bitcoin bubble indicator visualizes price basics, 60-days accumulative increase, a hot-keywords index, and a composite bubble index.

At 13.8 now, wise to consider selling when >= 80.

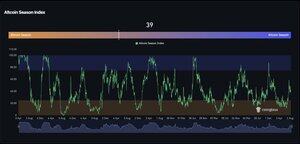

8. Altcoin Season Index

Gauges when alts outperform BTC. It tracks % of alts beating BTC, BTC dominance, volume/volatility, and sentiment.

Falling BTC.D and many alts outperforming $BTC = alt season.

Sell alts when > 75.

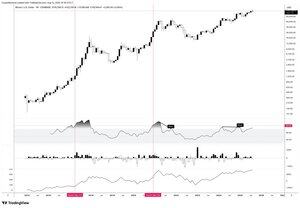

9. Mayer Multiple

= BTC price ÷ 200-day MA.

It measures how far price is from its long-term trend to gauge overbought/oversold situations.

Historically, 2.4 signals overheated and 0.8 oversold.

Current reading at 1.17

10. Monthly RSI

When BTC’s Monthly RSI hits ~80, pay attention.

Drop to the 1W timeframe to check for bearish divergences or a weekly RSI cross back below 80.

It won’t catch the exact top, but it’s a solid cue to de-risk and lock in profits.

That’s a wrap on Bull-Market Top Indicators 🫡

No single metric calls the top. Use confluence, Puell, Pi, MVRV-Z, NUPL, Mayer, BTC.D, Alt season Index, Monthly RSI; then plan exits.

Expect some alpha decay this cycle. If the rhyme holds, timing window is tight.

1,93K

Johtavat

Rankkaus

Suosikit