Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

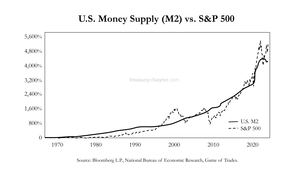

"For the last 30 years, the effective cost of capital has been the S&P 500 index.

This is the benchmark your capital has to return to avoid getting poorer.

The middle class use index funds (S&P 500, Vanguard 500, the Nasdaq 100) as a store of value. It's a way to gain exposure to a basket of stocks. That’s been the status quo since Jack Bogle first popularized it.

The S&P 500 index has gone up 7% per year for the last 50 years, while the U.S. dollar currency supply has also gone up 7%.

It doesn't take a rocket scientist to see that.

So effectively, when you buy the S&P 500, you own a basket of assets holding their value in real terms while trending up in nominal terms. And that's not awful—at least you don't get poor!

But, ideally, you want something growing at 14%."

—Michael Saylor

6,94K

Johtavat

Rankkaus

Suosikit