Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Chainlink’s dominance simply cannot be stopped

- Working with the largest financial institutions and market infrastructures in the world (Swift, DTCC, Euroclear, J.P. Morgan, Mastercard, Central Bank of Brazil, UBS, SBI, Fidelity International) on adopting tokenizing assets at scale, with a growing number of in-production use cases and more pre-production reaching live deployments

- Powers the DeFi economy with 68% market-share across all chains (84%+ on Ethereum) across hundreds of applications and 60+ public blockchain ecosystems, while expanding support for permissioned chains (Kinexys by J.P. Morgan, Canton Network by Digital Asset)

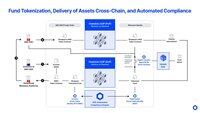

- Operates the only unified and modular platform that spans onchain data delivery, cross-chain interoperability, privacy-preserving compute, automated compliance, and legacy system connectivity (core requirements for tokenized assets and complex blockchain apps)

- Chainlink’s total value secured (TVS) in DeFi is $91B (incl borrows), which is directly monetized via MEV-recapture solutions like SVR, which has been adopted by the largest DeFi protocol (Aave w/ $65B TVL), capturing $450K so far with one user for one lending market on one blockchain (more growth to come)

- Has operated in-production for over 6 years with the highest level for security and reliability, even during extreme market volatility (e.g., FTX collapse, COVID dump) and blockchain network congestion (gas fee spikes in the thousands of USD), protecting DeFi for years

- Directly connecting protocol adoption with token value capture through the creation of the Chainlink Reserve which accumulates $LINK using offchain revenue from enterprise deals and onchain revenue from service usage (buybacks), with hundreds of millions of dollars in historical revenue

- Directly monetizes the integration of Chainlink into blockchain ecosystems via the Scale program and enterprise adoption via integration, usage, and maintenance deals, that fuel $LINK token buybacks from fiat and crypto fee payments

- Has been building oracle infrastructure since 2014 (before Ethereum) and working directly with Swift since 2016, with new protocols and services launched regularly to meet the growing demand from institutional users

- Working directly with the U.S. government officials and regulators, including meeting multiple times with the SEC, Treasury, and other departments, and met with Trump publicly multiple times, with the White House’s recent Digital Asset Report directly highlighting the importance of Chainlink and oracles

- Launched an automated compliance solution in collaboration with Apex Group (services $3.4T in assets), GLIEF (issuer of the only globally adopted & mandated G-20 initiated Legal Entity Identifier), and the ERC-3643 Association (widely adopted permissioned token standard), where ERC-3643 was just mentioned in a recent speech by the SEC chairman

- Directly powers many of the largest stablecoins, tokenized funds, and tokenzied equities with data/cross-chain/compliance as institutions are rapidly accepting their plans for issuing and adopting tokenized RWAs at scale

- Supported by one of the largest developer communities in the crypto ecosystem (tens of thousand of devs) along with vibrant active community that have an unlimited reserve of memes to deploy (memetic magik)

- Building a new architectural upgrade called the Chainlink Runtime Environment, which powers programmable workflows that enables the orchestration of complex applications/transactions that span onchain and offchain systems, serving as the operating system of crypto

And so more much

You just win $LINK

110,76K

Johtavat

Rankkaus

Suosikit