Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

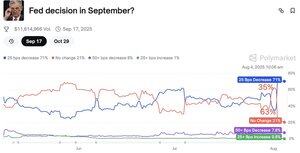

The probability of interest rate cuts is changing really fast!

Before Friday's non-farm payrolls, in September, the probability of no rate cut was 63%, and the probability of a 25 basis point rate cut was 35%

After Friday's non-farm payrolls, especially after the revision of the May-June data, the probability of no rate cut in September is 21%, and the probability of a 25 basis point rate cut is 71%

But regardless of the probability of interest rate cuts, everyone's panic about economic recession and whether there are other macro data frauds are even more worrying! 🧐

4.8. klo 09.49

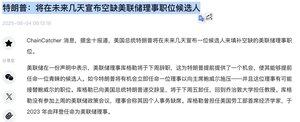

The Fed's interest rate changes are mainly voting, with 2 chairmen (chief and deputy), 5 governors, and the president of the Federal Bank of New York + 4 of the 11 local federal bank presidents, a total of 12 people.

And every personnel change in the Fed will affect the market's expectations for future interest rates. The upcoming replacement of Fed governors, and the new appointments are likely to be directly appointed by Trump, which may have an important impact on the Fed's future monetary policy direction. I guess the newly appointed person is likely to be Powell's potential successor, as Powell's term is coming to an end.

It is expected that this new director will definitely be a "big pigeon" and will cooperate with Trump to accelerate interest rate cuts. This can also be regarded as injecting certain positive expectations into the market (but expectations are expectations, and landing is landing, these are two different things)

Under this expectation, there is a high probability that U.S. Treasury yields may fall first, risk assets (especially Nasdaq constituent stocks) will rise in advance, and funds will return to the stock market 🧐

Therefore, this is Trump's bull market, although the macroeconomy is a little unsustainable, but it has been artificially giving a boost. Maintaining next year's midterm elections is also a top priority! 🧐

51,33K

Johtavat

Rankkaus

Suosikit