Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

These stock picks

Don't look at chips, just focus on these things related to building data centers.

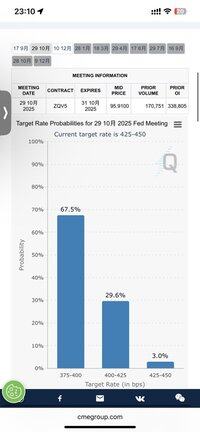

$vst power plants are inherently high-debt, heavy-asset industries. If interest rates drop, it can directly improve $vst's profit margins, similar to real estate stocks.

$gev is not a heavy-asset, high-leverage company, but many of $gev's grid customers are of that type.

$fix contractors are not directly benefited, but many of the contractors' clients are those types of companies. A rate cut can revive struggling clients, aside from the giant data centers.

$vrt is indeed not significantly affected by interest rate cuts.

Oh right, you can start paying attention to real estate stocks now... $itb $rkt $open and such.

30.7.2025

$vrt's earnings report double beats are not hard to guess. Given that $gev and $fix's earnings reports are explosive, $vrt can't be that bad.

For the entire data center chain, if we were to create an ETF, it would look something like this: is enough.

Chips $nvda $amd for inference/training, $avgo provides optical interconnect and ASIC IP.

Manufacturing: $tsm

Cooling subsystems $vrt

Power grid $gev

Power station $vst

Big brother package project $fix

Upstream AI demand and CapEx from $msft $goog $amzn $meta $tsla $aapl $crwv $orcl and many others.

If you want to recommend stocks to me, please specify who is making money from that stock.

13,07K

Johtavat

Rankkaus

Suosikit