Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

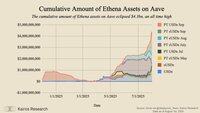

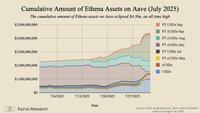

Ethena Assets on @Aave Reached All-Time High Amid Launch of “Liquid Leverage”

The total value of Ethena-related assets supplied to Aave reached a new all-time high of $4.3 billion, following the introduction of the “Liquid Leverage” initiative. This growth has been driven primarily by rollovers from the PT-sUSDe-July market into the PT-sUSDe-September market, alongside fresh inflows of sUSDe and USDe, both of which appear to have been catalyzed by newly introduced incentives.

The PT-sUSDe-September market now accounts for 50% of the entire sUSDe supply ($2.45 billion), with $1.97 billion of that held on Aave. When including vanilla sUSDe positions on the platform, over 64% of the total sUSDe supply is currently deployed to Aave, underscoring the deepening integration between Ethena and crypto's largest lending protocol.

This surge in supply-side activity culminated on July 30th, which marked the largest single-day net inflow of Ethena assets to Aave to date, more than 2.2x the previous peak recorded on December 8th, 2024.

big thank you to @sealaunch_ for curating this data!

29.7.2025

Introducing Liquid Leverage, a new Ethena integration on money markets enabled by partners, launching first on @aave 👻

Users can now deposit 50% sUSDe & 50% USDe into Aave and earn promotional rewards for USDe (currently ~12% APY), in addition to the normal USDe lending rate and sUSDe's native APY

22,68K

Johtavat

Rankkaus

Suosikit