Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

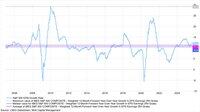

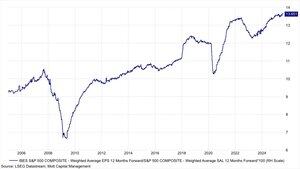

🧵1) For below-average growth, investors are paying an above-average multiple for the S&P 500. One might expect that, with the index heavily weighted toward the “Mag7,” growth would be higher.

2/2 Margins are higher, but growth is significantly lower, making it difficult to justify current valuations. Earnings are weighted, and margins already reflect the composite of the index.

82

Johtavat

Rankkaus

Suosikit